"Just hold overnight" - it's become the market's favorite open secret. Traders everywhere discuss the overnight edge in NQ futures as if it's a guaranteed path to profits. And while the overnight effect is real, treating it as a one-size-fits-all strategy is dangerously oversimplified.

I decided to put this conventional wisdom under the microscope. Instead of accepting the broad "overnight edge" narrative, I broke down the strategy day by day throughout 2024. What I discovered shows that timing isn't just important - it's everything. The results paint a fascinating picture of how this widely-known edge actually behaves in the real world.

The Experiment

The setup was beautifully simple:

Buy NQ at the 4:00 PM EST market close

Hold overnight

Sell at the next day's 9:30 AM EST market open

I ran this strategy throughout 2024, analyzing each weekday pair separately. The results revealed striking differences between different days of the week.

A Tale of Five Trading Days

Wednesday to Thursday: The Golden Window

The standout performer was, surprisingly, the Wednesday to Thursday overnight hold. This period showed an almost algorithmic consistency, turning an initial -$2,000 into a stunning +$70,000 over approximately 50 trades. The equity curve for this period looks like something you'd expect from a hedge fund's marketing brochure - a smooth, upward trajectory with minimal drawdowns.

Friday to Monday: The Weekend Warriors

The weekend hold (Friday to Monday) tells a tale of two halves. The strategy started brilliantly, building up to +$25,000 by trade 30, marked by consistent wins. However, a sharp drop followed, though recent trades show signs of recovery. This pattern suggests that weekend news and global events can significantly impact Monday's open.

Monday to Tuesday: The Challenging Start

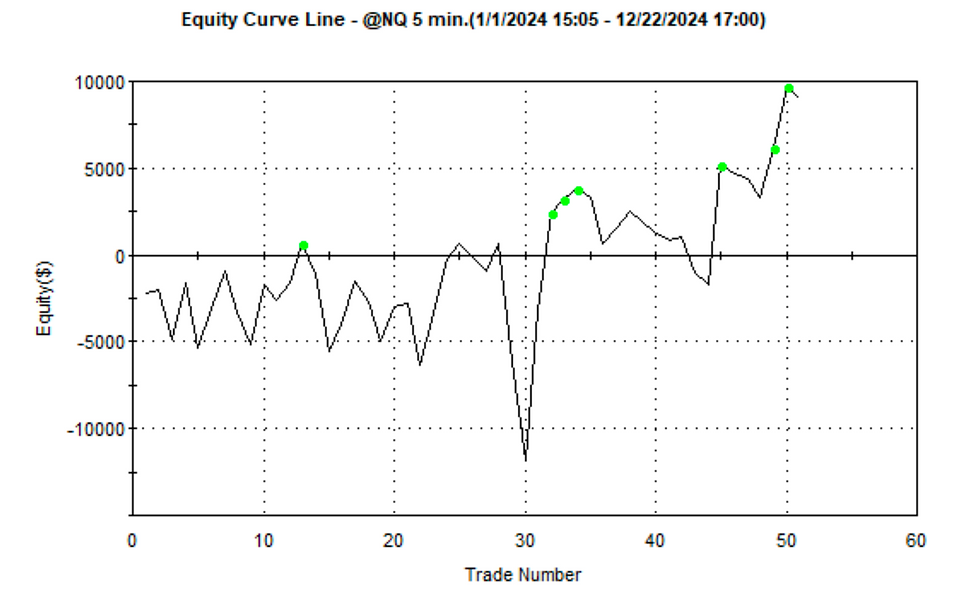

Monday to Tuesday proved to be the most challenging period. The equity curve looks like a rock climber's worst nightmare - a deep descent to -$14,000 before beginning a recovery. This could reflect the market digesting weekend news and adjusting to new information.

Tuesday to Wednesday: The Comeback Kid

This period showed resilience amid volatility. While not as consistent as Wednesday-Thursday, recent trades show strong upward momentum, suggesting a possible emerging pattern.

Thursday to Friday: The Rollercoaster

Thursday to Friday trades were marked by significant volatility. Despite some impressive winning streaks (notably at the start and around trades 35-40), substantial drawdowns make this period feel like trading on a rollercoaster.

Key Insights

Day Matters: The dramatic difference between Wednesday-Thursday (+$70,000) and Monday-Tuesday (significant drawdown) shows that not all overnight holds are created equal.

Pattern Recognition: The consistency of Wednesday-Thursday performance suggests there might be structural reasons behind this pattern - perhaps related to option expiration cycles or institutional trading patterns.

Risk Management: The varying performance across different days emphasizes the importance of position sizing and risk management. What works on Wednesday might blow up your account on Monday.

Trading Implications

This experiment reveals several actionable insights:

Consider concentrating overnight positions on Wednesday-Thursday, where the edge appears strongest.

Be more cautious with Monday-Tuesday trades, possibly reducing position size or avoiding them altogether.

For Thursday-Friday and Friday-Monday trades, stronger risk management rules might be necessary due to higher volatility.

Looking Forward

While past performance doesn't guarantee future results, these patterns are too consistent to ignore completely. The challenge for traders will be adapting these insights to changing market conditions while maintaining disciplined risk management.

Remember, the market is always evolving, and strategies that work today might not work tomorrow. However, understanding these overnight holding patterns adds another tool to our trading arsenal.

Have you noticed similar patterns in your trading? I'd love to hear your experiences and insights in the comments below.

コメント